Buy Now Pay Later In ECommerce: Models And Examples

The Juniper Research report titled “Buy Now Pay Later: Regulatory Framework, Competitive Landscape & Market Forecasts 2022-2027” predicts that the global user base for Buy Now Pay Later (BNPL) will exceed 900 million by 2027. In Vietnam, the BNPL payment method is expected to experience an annual growth of 126.4%, reaching 1,123.9 million USD in 2022.

1. What is Buy Now Pay Later (BNPL)?

Buy Now Pay Later (BNPL) is a short-term financial arrangement that allows consumers to make immediate purchases and defer the payment to a future date, typically without accruing interest.

How it works

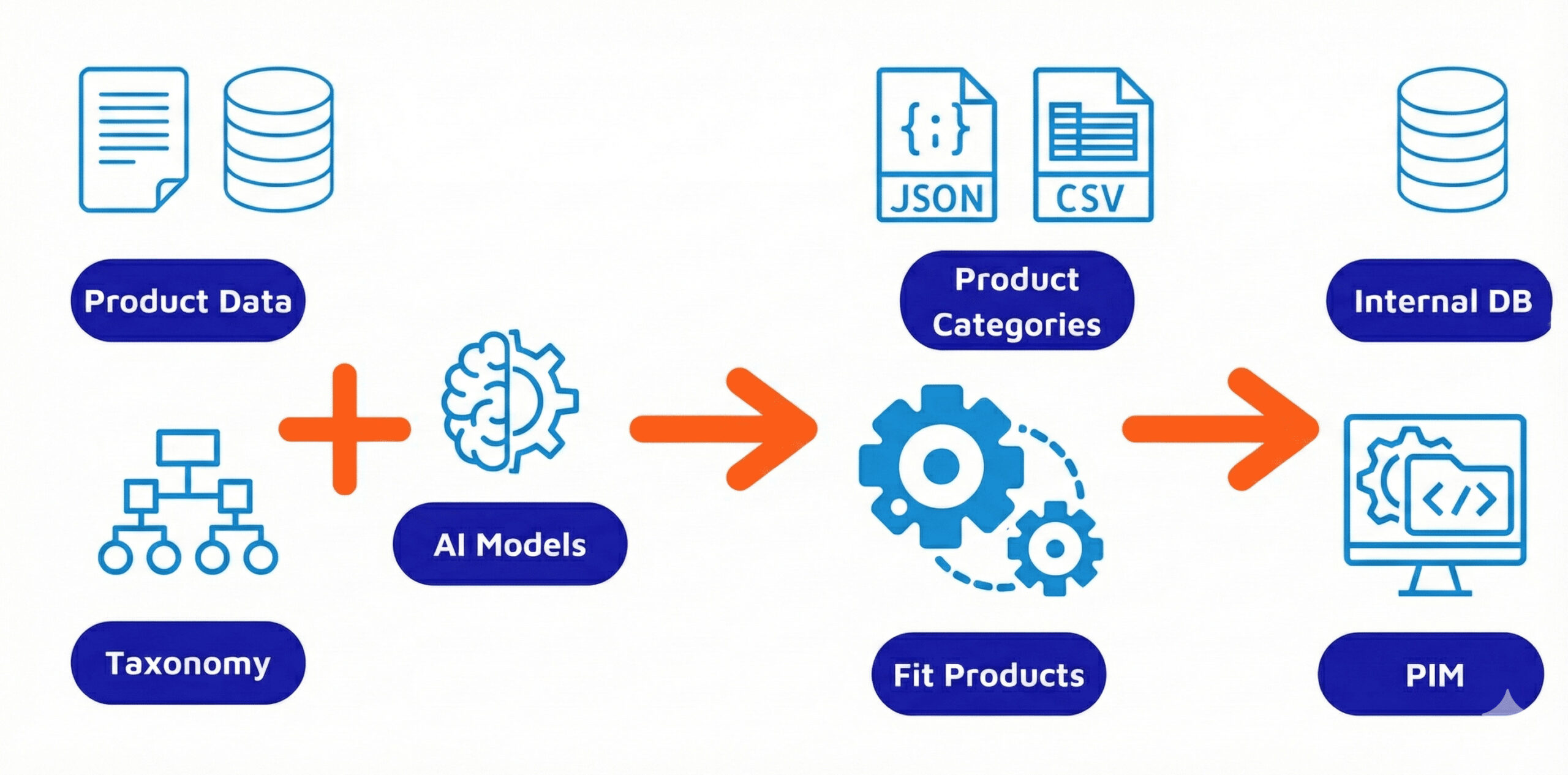

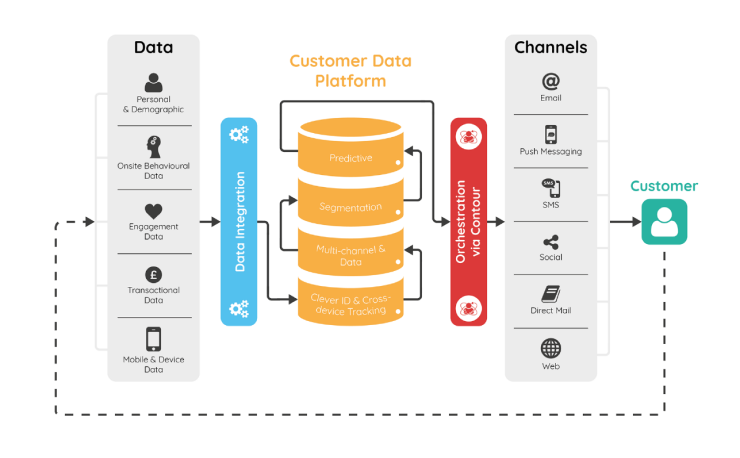

In BNPL, the financial technology (Fintech) organization facilitating the service directly pays the purchase amount to the seller on behalf of the customer. The customer then repays this amount gradually to these organizations over a period, often extending from one to several months.

When using BNPL, customers can make payments through bank transfers or have the amount automatically deducted from their debit card, bank account, or credit card. While the specific terms and conditions may vary between companies offering BNPL services, the general operational mechanism is similar to credit card instalment plans. However, BNPL is often considered much simpler, and additionally, it typically does not involve interest charges; instead, late payment fees are calculated as a percentage of the product or service value.

Pros and Cons

For customers

With the BNPL model, consumers can make immediate purchases even if they don’t have the financial capacity to pay the entire shopping cost upfront. This payment is divided into shorter instalment periods, corresponding to smaller amounts, reducing financial pressure on consumers. Additionally, BNPL typically does not entail annual fees or hidden charges, and the registration process is simple and quick, averaging less than 15 minutes. In general, BNPL companies usually only require customers to be at least 18 years old and own a bank card, without specifying a minimum personal income.

However, BNPL often comes with a relatively low consumer spending limit, typically ranging from 20 to 30 million VND, to meet the needs of purchasing items such as fashion, cosmetics, phones, laptops, electronic components, etc. If consumers do not know how to control their spending, they may easily engage in excessive shopping as there is no immediate need to pay the full amount at the time of purchase. This can lead to late payments for the instalment periods and additional penalty fees.

For businesses

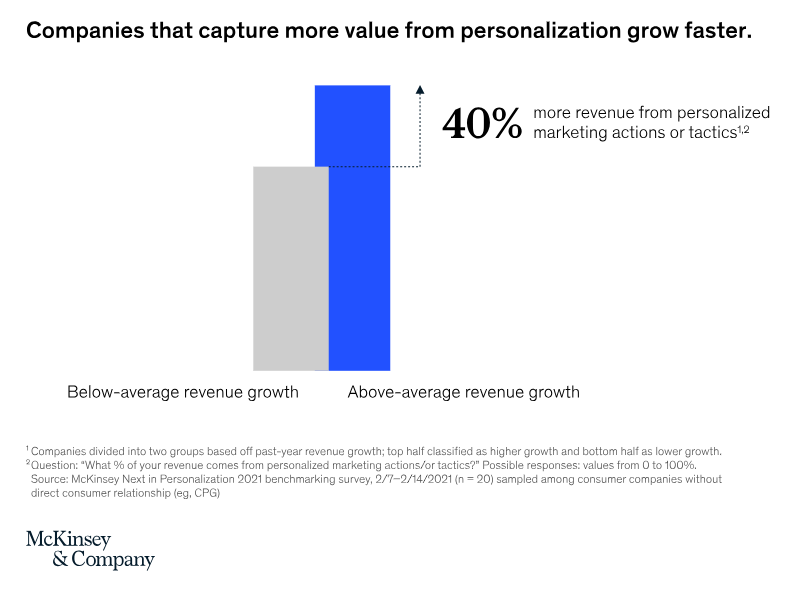

Collaborating with BNPL organizations to launch BNPL programs with 0% interest can help businesses attract more customers without incurring excessive marketing costs. With this approach, businesses can encourage customers to make purchasing decisions more quickly without extensive financial consideration, thereby significantly boosting revenue. Moreover, instead of offering discounts or freebies, the ability to pay gradually without urgency and without incurring interest aligns with customer psychology and needs.

However, many businesses still hesitate to implement BNPL models due to concerns about not being able to control the debt of individual customers. Additionally, this potential model is relatively new to the Vietnamese market, so there are not many payment service providers offering BNPL services, and there is a scarcity of experienced eCommerce website development units capable of efficiently integrating this functionality.

2. Compare Buy Now Pay Later with Credit Cards

The BNPL model is revolutionizing the global consumer credit sector, but many people still confuse BNPL with credit card instalment plans offered by banks.

So, what are the differences between Buy Now Pay Later and credit cards?

| Format | Buy Now Pay Later | Credit Card |

| Unit accepting payment | The seller allows BNPL payment method | Banks issue credit cards |

| Registration process | Register quickly, completely online | The procedure requires a lot of paperwork |

| Time | 1 to 3 minutes | Have to wait for censorship, which can take up to several days, even weeks |

| Credit limit | Depends on buyer profile | Depends on buyer profile |

| Card maintenance fee | All free | Average 299,000 VND/year |

| Registration fee | All free | Average 50,000 VND/card |

| Conversion fee in instalments | All free | Average 200,000 VND/transaction, or calculated as a percentage of transaction value |

Comparison table of Buy Now Pay Later with Credit Card

Despite trailing behind the global trend, the BNPL model in Vietnam is forecasted to explode due to the market falling into a favourable timeframe. This is influenced by the impact of the Covid-19 pandemic, which has significantly propelled the development of online shopping and eCommerce. Additionally, the BNPL model aligns more with the preferences of Generation Z than traditional credit cards.

3. Case studies

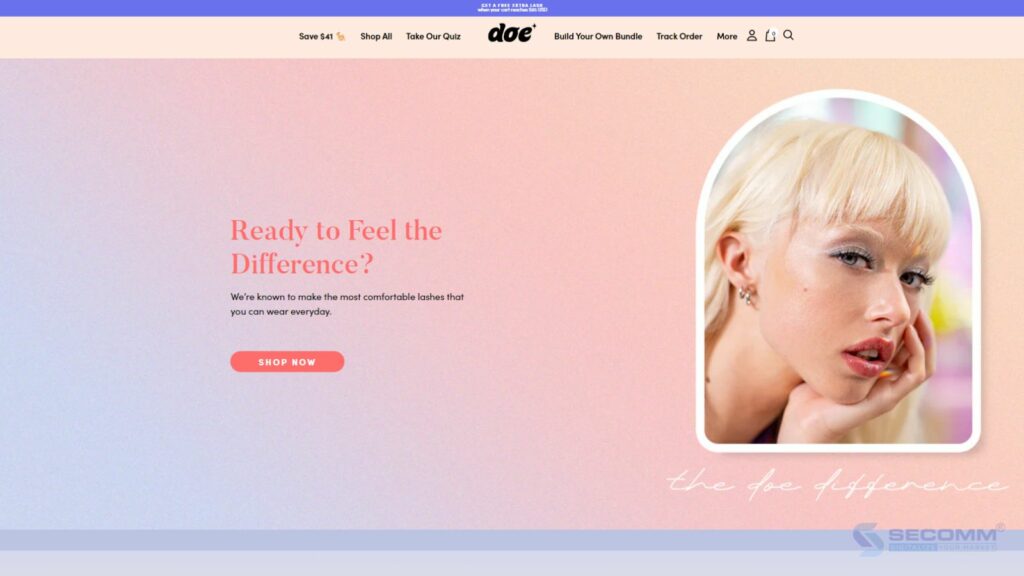

Tiki and Sendo – Two of the four kings of eCommerce participating in BNPL

Two out of the four largest eCommerce platforms in Vietnam have begun implementing BNPL, affirming the tremendous potential of this model in the online shopping market.

In 2020, Sendo was a pioneer in eCommerce by early adoption of BNPL through collaboration with financial solution provider Atome, offering Buy Now Pay Later services. With BNPL, Sendo aims to make shopping more convenient for customers, removing concerns about financial issues often associated with credit cards, such as increasing interest rates for late payments over an extended period.

Since the beginning of 2022, Tiki has collaborated with two financial service providers, Home Credit and Lotte Finance, to launch the ‘Buy Now Pay Later’ project, enhancing smart payment solutions directly within the Tiki app. This initiative not only supplements intelligent payment options for Tiki users but also empowers customers to manage their personal finances better when engaging in online shopping, thereby further enriching the overall eCommerce experience for consumers.

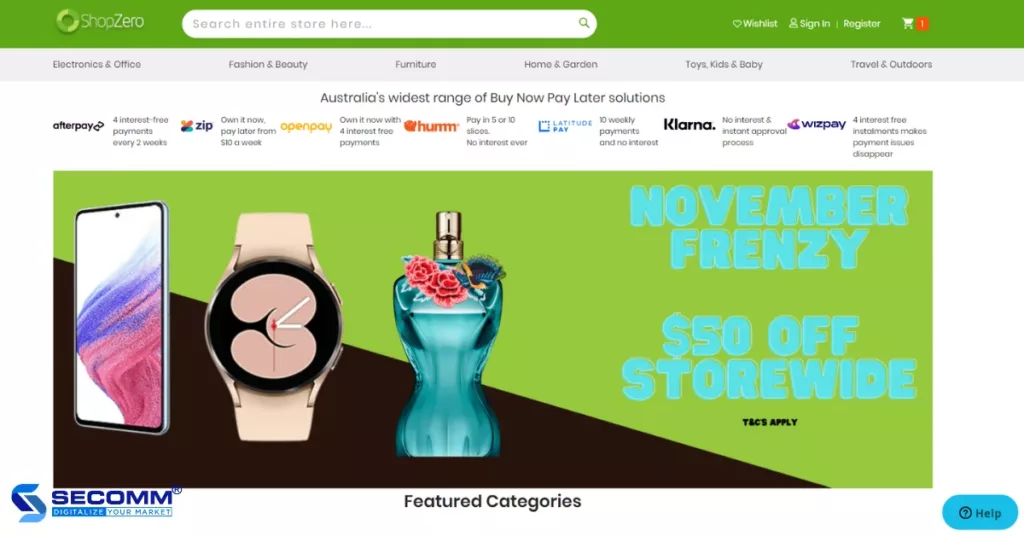

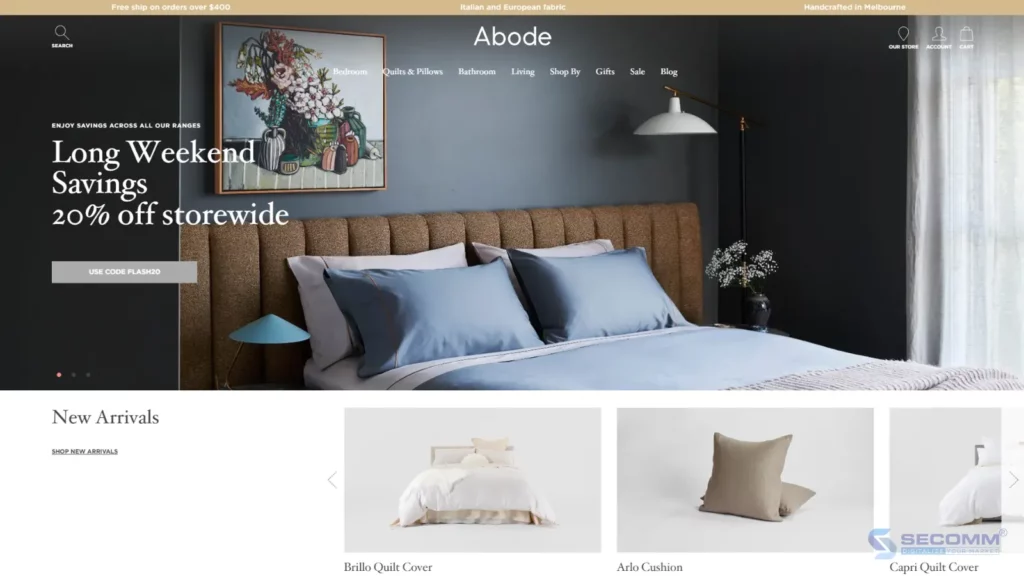

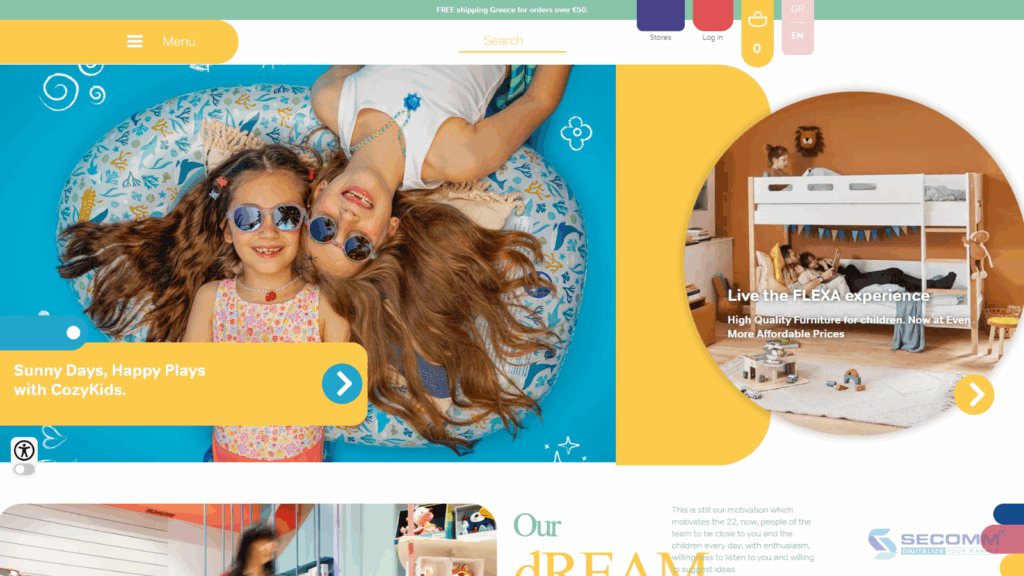

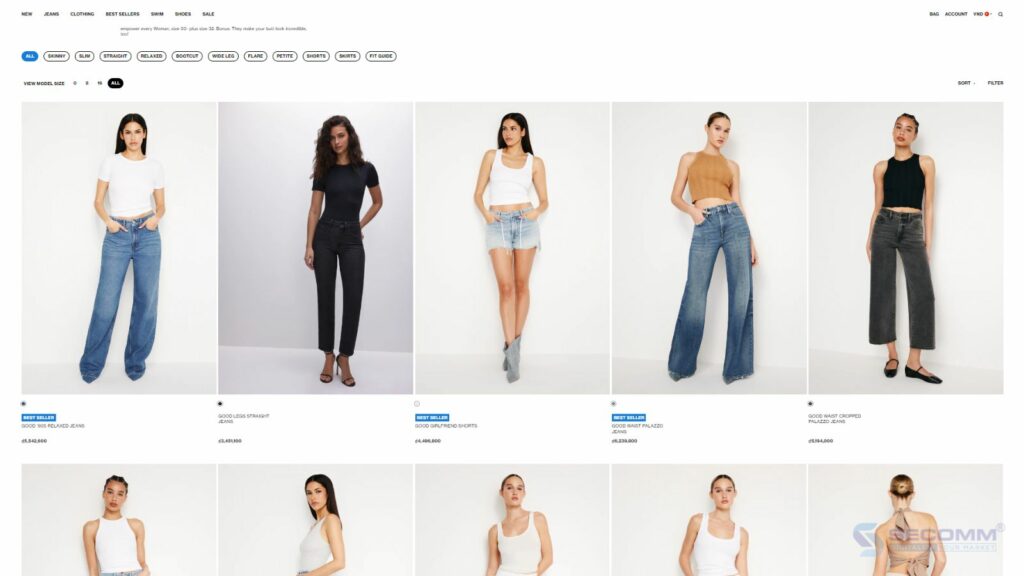

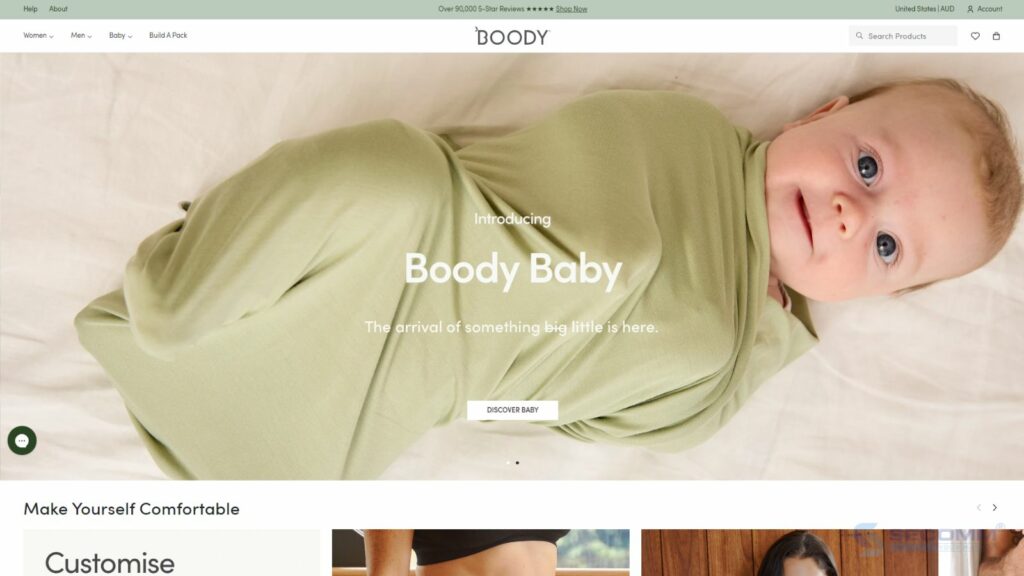

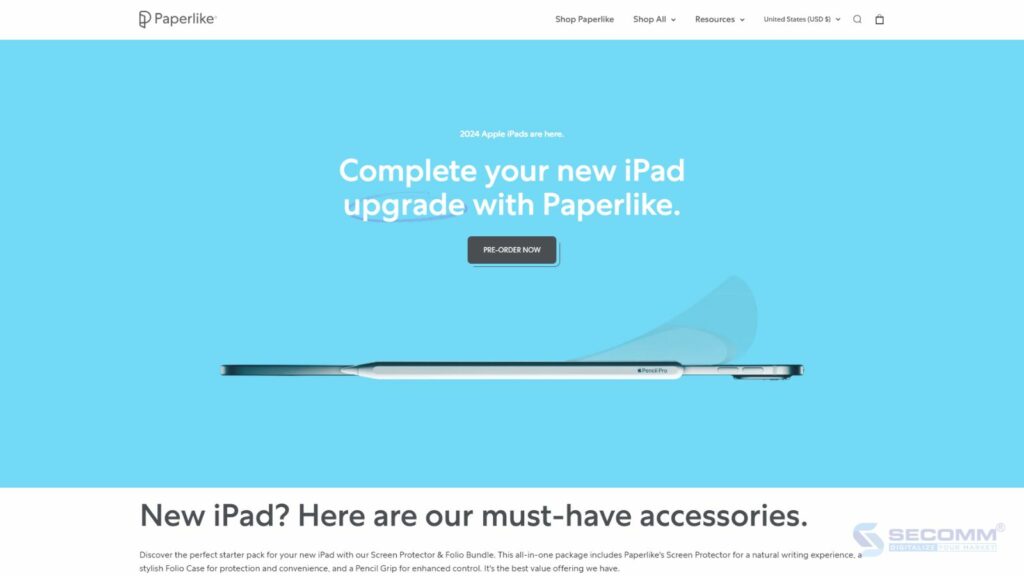

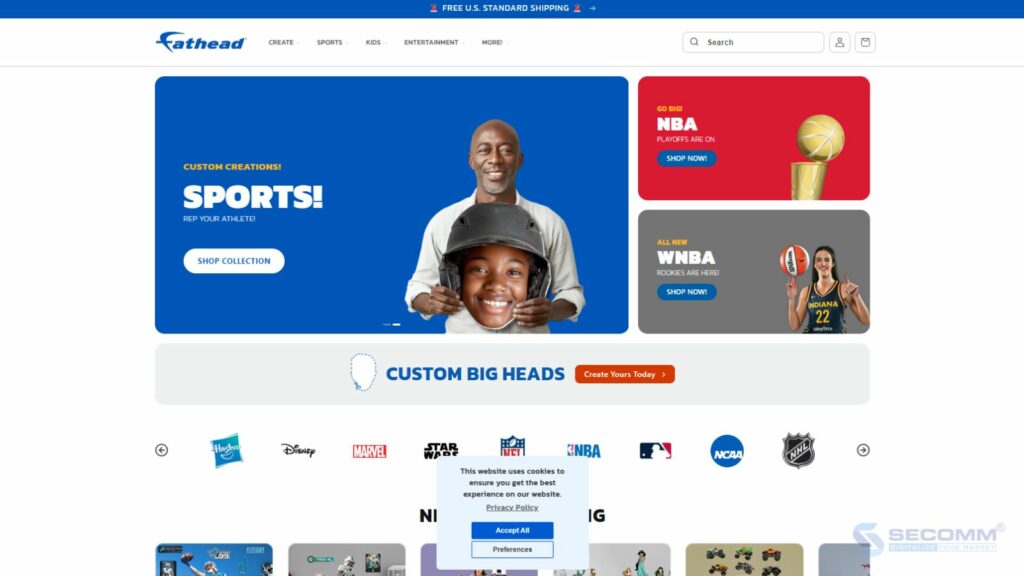

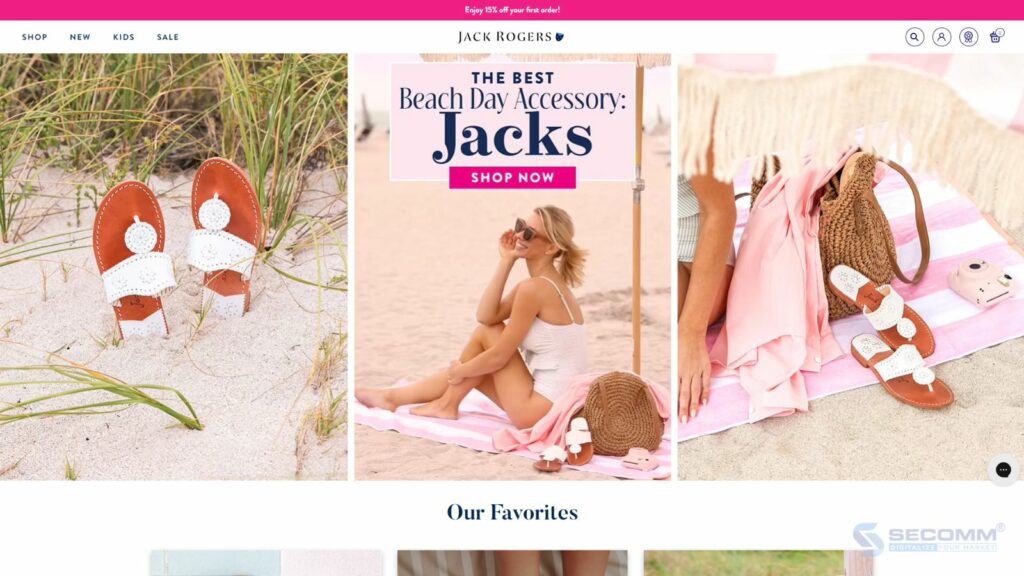

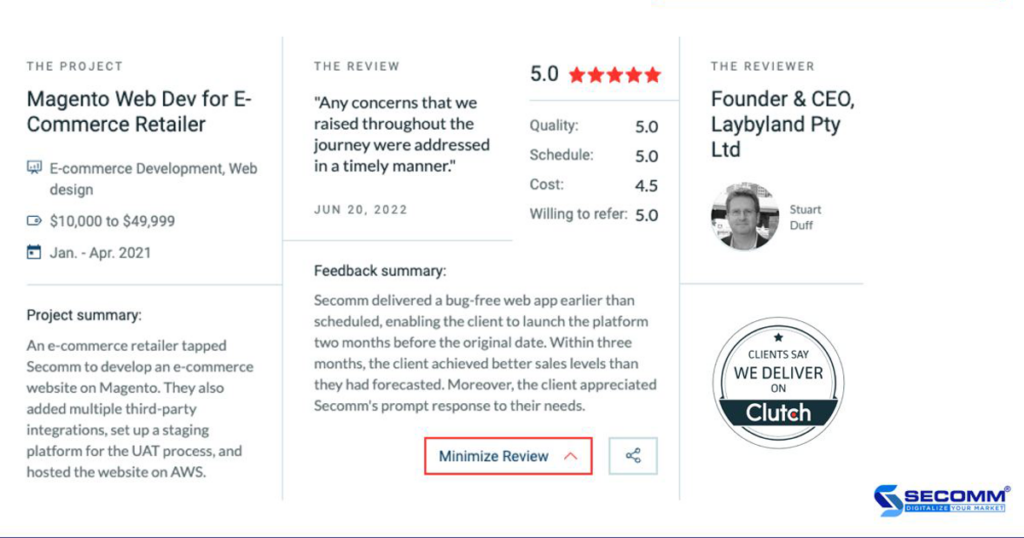

Laybyland – The leading brand in the Buy Now Pay Later model in Australia

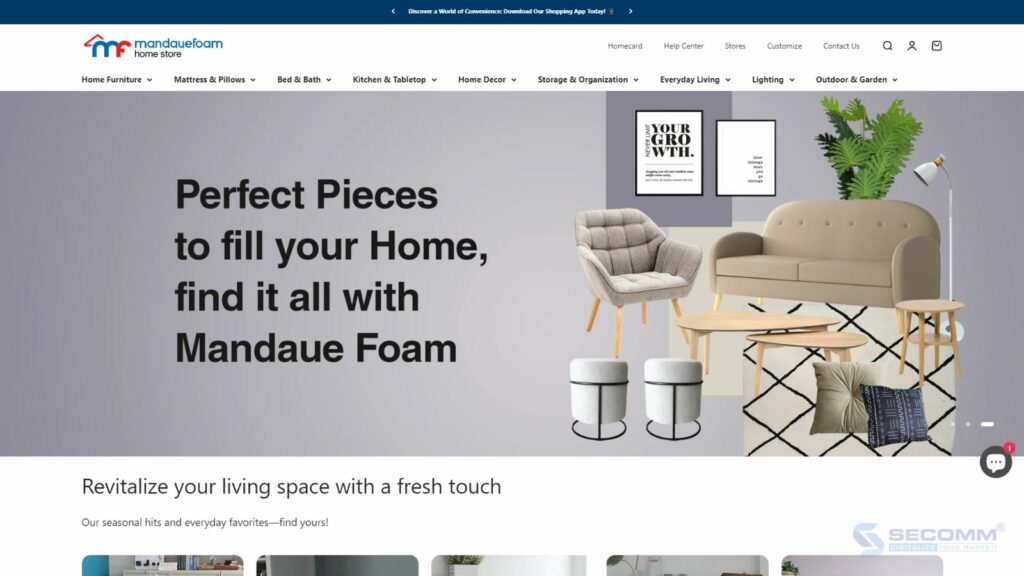

Laybyland was established in 2012 in Australia with two key eCommerce business models: Layby (Pay Later) and Shop Now Pay Later (Shopzero). Over its 10 years of eCommerce operations in the Australian market, the business has witnessed remarkable growth. Starting with +10,000 products across two initial websites, it has expanded to offer over +400,000 products daily across five online stores, including Laybyland, Shopzero, Mylayby, and Layawayland.

Shopzero, a part of Laybyland, provides BNPL services through seven main partners: Afterpay, Zip, Openpay, Humm, Latitude, Klarna, and Wizpay. Notably, Shopzero maintains complete control and operation over all BNPL activities and payment processes within its system. Pioneering the BNPL market has brought Shopzero significant success, especially in the electronics, office supplies, fashion, cosmetics, furniture, gardening tools, children’s toys, and travel sectors.

It is evident that BNPL is contributing to a significant revolution in consumer payment habits, shifting from a payment method choice to a crucial factor in customer purchasing decisions.

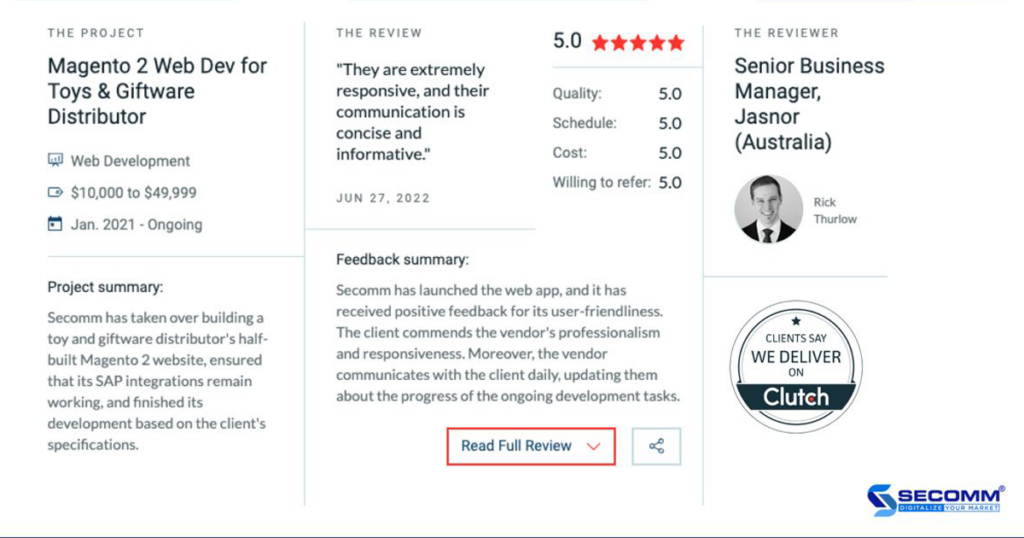

With extensive experience in implementing eCommerce solutions in various countries, especially in the Buy Now Pay Later market, SECOMM understands the challenges businesses face when exploring how to establish Buy Now Pay Later systems.

Contact SECOMM now or call us via hotline (+84)28 7108 9908 for a free consultation on detailed eCommerce system development solutions!

Comment (0)