It seems we can’t find what you’re looking for. Perhaps searching can help.

Sign Up for newsletter!

Subscribe to get the latest eBook!

Hotline

Buy Now Pay Later (BNPL) payment methods have become a global trend, making it easier for consumers to shop without paying the full amount upfront. Below are some of the most famous BNPL providers worldwide.

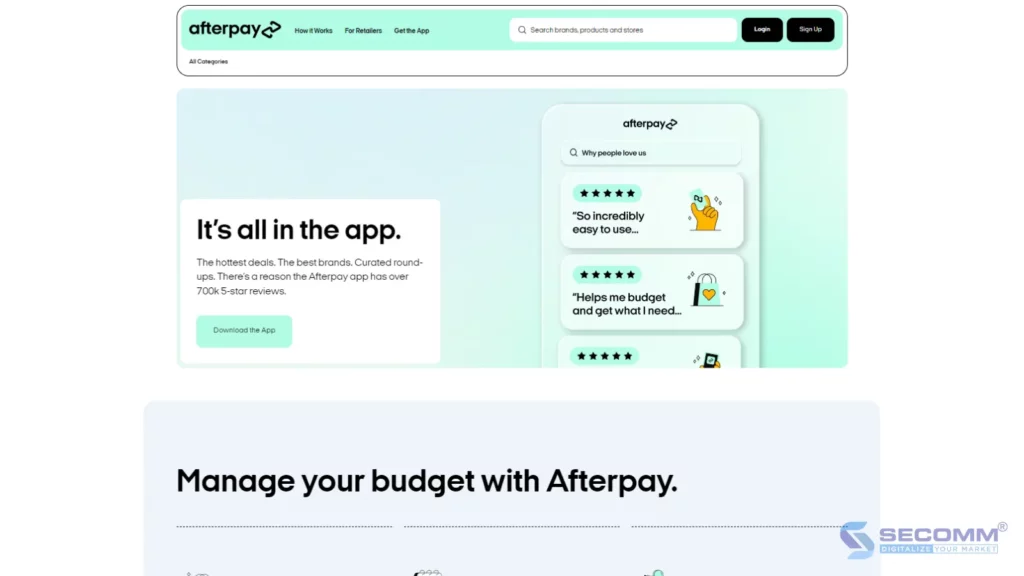

Afterpay is one of the most popular BNPL services globally, especially in Australia, the US, and the UK. Founded in 2014 in Australia, Afterpay quickly expanded to many other markets and became a well-known name in the BNPL industry.

How it works: Afterpay allows consumers to split their payments into four interest-free installments over two weeks. No credit checks are required, and it is easily integrated into many eCommerce websites.

Benefits:

Drawbacks:

Klarna is a Swedish fintech company providing BNPL services in many European countries and the US. With over 90 million users worldwide, Klarna is one of the largest BNPL providers.

How it works: Klarna offers various payment options, including paying in 30 days, splitting payments into four interest-free installments, or long-term financing with interest.

Benefits:

Drawbacks:

Affirm is a BNPL service from the US, founded by Max Levchin, one of the co-founders of PayPal. Affirm allows consumers in the US and Canada to shop and pay in flexible installments.

How it works: Affirm offers loans with payment terms from 3 to 36 months with clear interest rates from 0% to 30%, depending on the consumer’s credit.

Benefits:

Drawbacks:

Zip is a BNPL service based in Australia, operating in several countries including the US, the UK, and New Zealand. Zip offers flexible payment solutions for consumers.

How it works: Zip allows consumers to split payments into four interest-free installments every two weeks or choose longer-term financing with interest.

Benefits:

Drawbacks:

Sezzle is a BNPL service from the US, primarily operating in North America. Sezzle focuses on providing flexible payment solutions for young consumers.

How it works: Sezzle allows consumers to split payments into four interest-free installments over six weeks. No credit checks are required during registration.

Benefits:

Drawbacks:

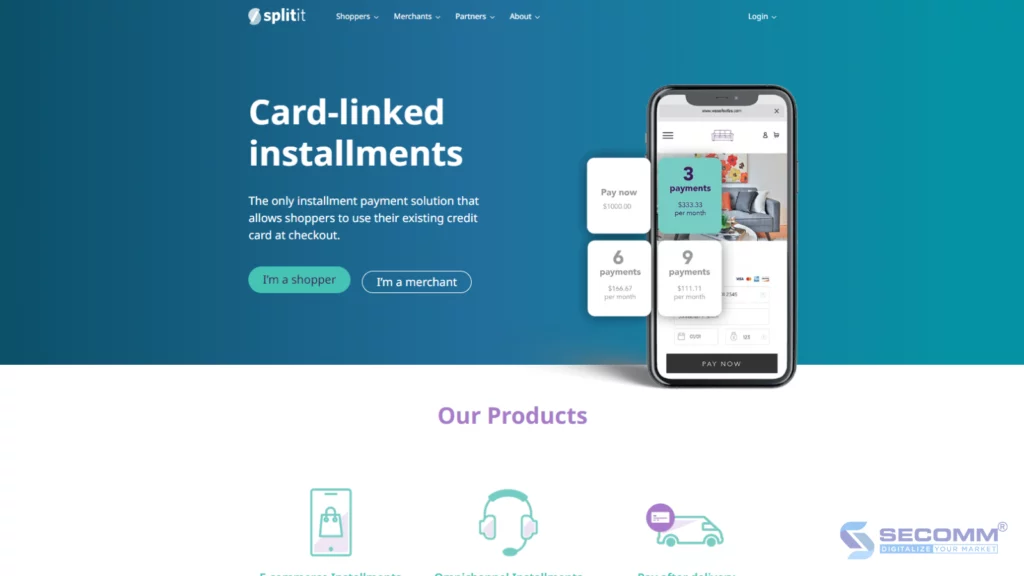

Splitit is another BNPL service from the US, with a different approach compared to traditional services. Splitit uses the available credit limit on consumers’ credit cards to split payments.

How it works: Splitit allows consumers to split payments into interest-free installments by holding the credit limit on their credit cards.

Benefits:

Drawbacks:

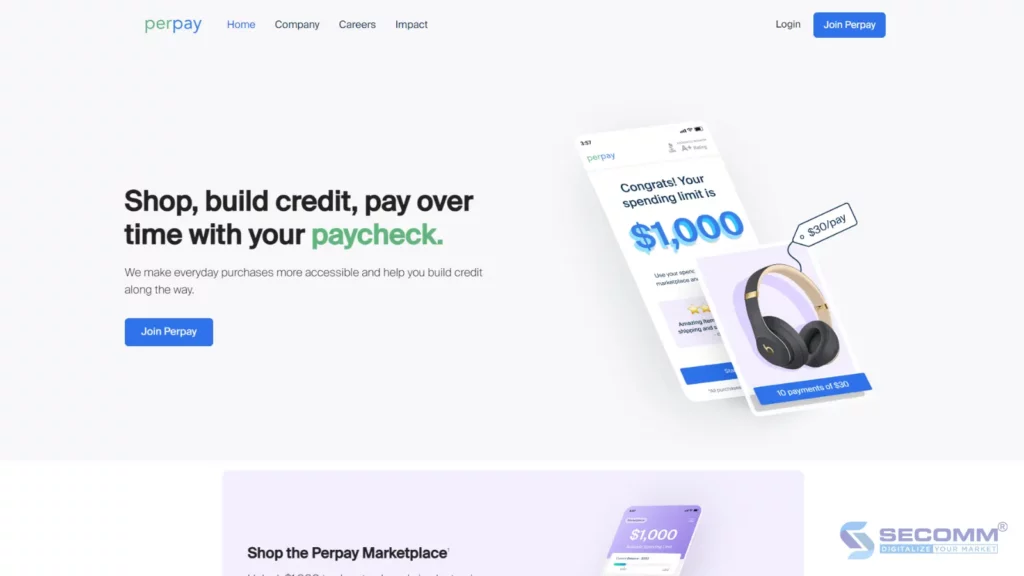

Perpay is a BNPL service from the US, focusing on helping consumers purchase everyday products and pay in installments through direct payroll deductions.

How it works: Consumers can shop on the Perpay platform and pay monthly installments through direct payroll deductions.

Benefits:

Drawbacks:

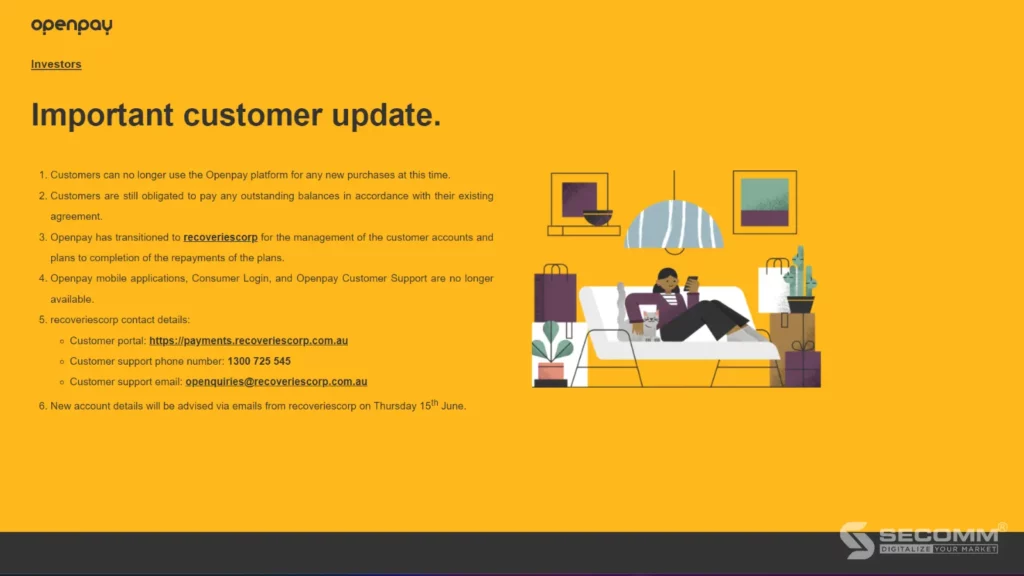

Openpay is a BNPL service from Australia, offering flexible payment plans for consumers and businesses in Australia, New Zealand, and the UK.

How it works: Openpay allows consumers to split payments into flexible installments ranging from 2 to 24 months.

Benefits:

Drawbacks:

FINAL WORDS

The Buy Now Pay Later (BNPL) services have revolutionized how consumers shop globally, providing significant flexibility and convenience. Providers such as Afterpay, Klarna, Affirm, Zip, Sezzle, Splitit, Perpay, and Openpay have developed diverse financial solutions, meeting the needs of both consumers and businesses. Each service has its own advantages; however, using BNPL also comes with challenges such as late fees, the risk of overspending, and the impact on credit scores if not managed well.

To maximize the benefits of BNPL, consumers need to manage their finances carefully and choose the service that fits their needs and capabilities. Meanwhile, businesses should continue to work closely with BNPL providers to offer the best shopping experience for customers while fully exploiting the potential of this payment method.

2

2

6,719

6,719

0

0

1

1Subscribe to get the latest eBook!

Hotline